Companies are under growing pressure from investors, customers, and regulators to disclose their greenhouse gas (GHG) emissions. This data is essential for understanding just how much each business contributes to climate change and for establishing credible emissions-reduction targets, a key part of any organization’s broader climate plan. It also allows companies to benchmark their progress toward their climate-related goals, offer transparency to investors, and promote a more thorough understanding of climate-related risks and opportunities.

Exclusive analysis by Manifest Climate shows that right now emissions disclosures are patchy and inconsistent within and between different economic sectors. This needs to change — and fast. Many companies are poised to fall under one or more climate-related disclosure regimes in the coming months, forcing them to report standardized emissions data in their financial filings.

The SEC and ISSB demand emissions disclosures

This year, several high-profile bodies have taken steps to mandate climate-related disclosures that include GHG emissions reporting. In March, the US Securities and Exchange Commission (SEC), and the International Sustainability Standards Board (ISSB) both released draft climate risk disclosure rules for organizations.

In respect to GHG emissions, the SEC proposal would require public companies to disclose the emissions they are directly responsible for (Scope 1) and those they are indirectly responsible for through their purchase of electricity (Scope 2). In certain situations, it would also force companies to report the emissions produced through their value chains and the use of their products (Scope 3). All these disclosures would have to be made in companies’ registration statements and periodic filings. Furthermore, the SEC rule would force companies to get third-party assurance that their reported GHG numbers are accurate.

Meanwhile, the ISSB’s draft climate-related disclosure standards would require organizations to report against seven cross-industry metrics, including Scope 1, 2, and 3 emissions on an absolute and intensity basis. A company that discloses using these standards would have to report using the GHG Protocol, a globally recognized standard, for their consolidated accounting group and for associates, joint ventures, unconsolidated subsidiaries or affiliates.

Emissions disclosure challenges

Measuring and reporting GHG emissions is a big ask for many companies. Getting hold of Scope 3 figures is especially tricky. Often, this data has to be sourced directly from those entities upstream and downstream of a reporting company’s value chain.

In order to meet disclosure requirements, businesses will have to put processes in place to extract this information from value-chain partners and third parties — and then get it verified to boot. Many companies have yet to put such processes in place, which partly explains why many do not report their Scope 3 emissions — because they don’t have access to them.

How companies disclose emissions data today

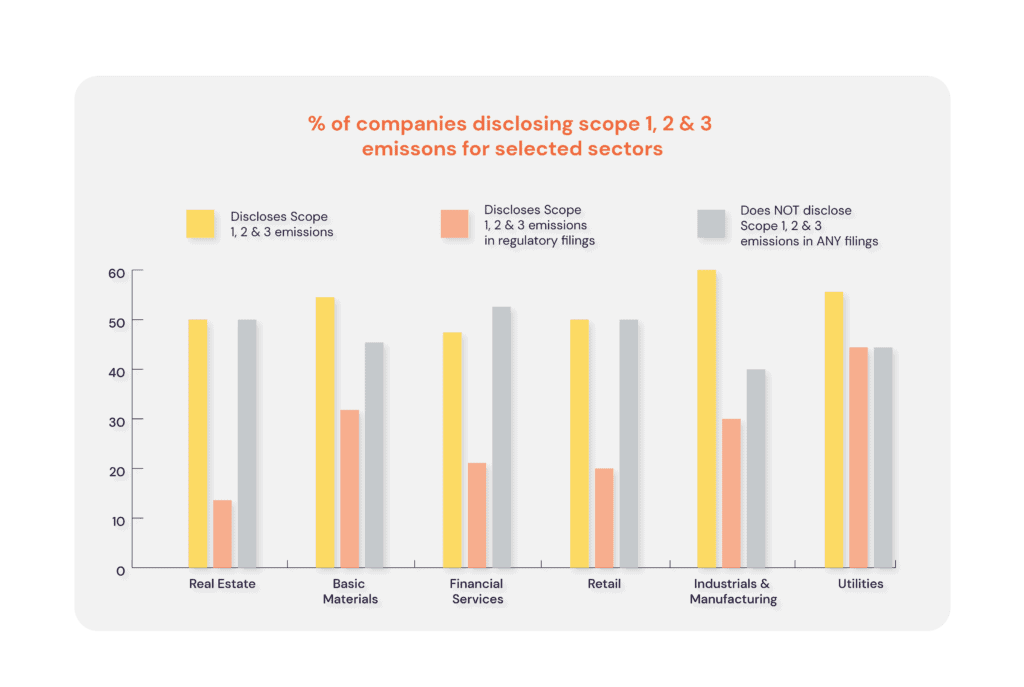

Manifest Climate manages a large database of climate-related disclosures issued by companies from a wide range of economic sectors and geographies. Analysis of a sample of 117 major firms from around the world in this database found discrepancies in reporting of GHG data across sectors and emissions scope.

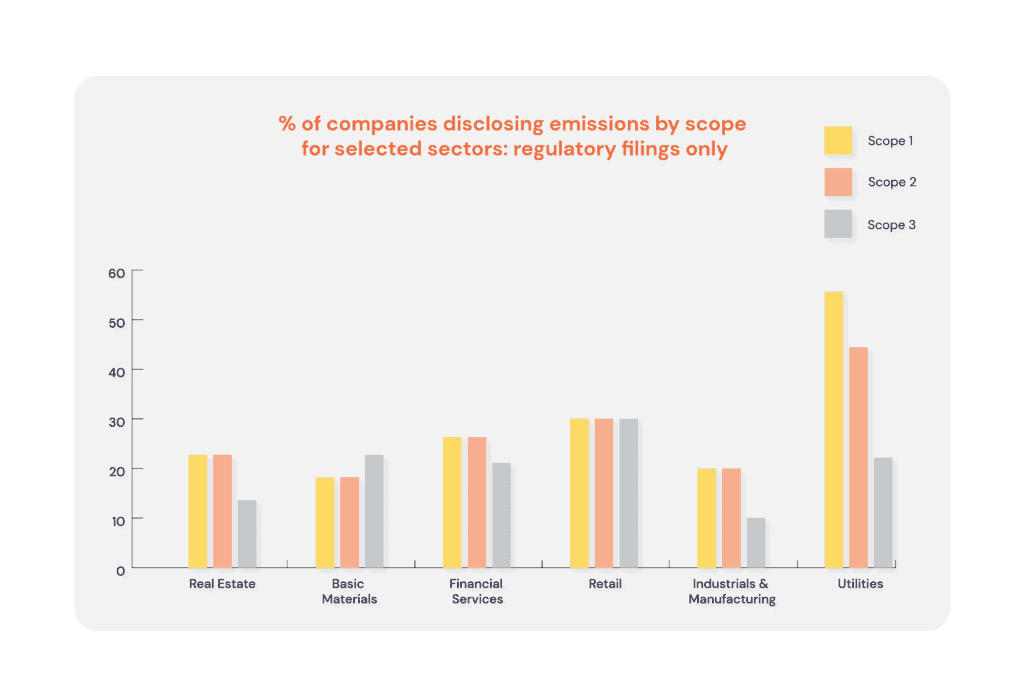

We observed that while 76% of all companies disclosed Scope 1 and Scope 2 emissions, just 55% reported their Scope 3 emissions. Furthermore, just one-third of all companies included their emissions data in their regulatory filings — a requirement of the incoming SEC and ISSB rules. These figures show that most companies have work to do to improve their emissions reporting.

Our analysis also reveals the extent to which emissions disclosures vary by sector. For example, of Manifest Climate’s sample of real estate companies, 73% reported their Scope 1 and 2 emissions, and 64% their Scope 3 emissions. In contrast, of companies in the basic materials sector (which includes oil and gas extraction, metals, and other commodities), 68% disclosed their Scope 1 emissions, 64% their Scope 2 emissions, and just 50% their Scope 3 emissions.

These percentages dropped sharply when taking into account just those disclosures made in regulatory filings. Only 14% of real estate companies in our sample reported Scope 1, 2, and 3 data in their regulatory filings, and 32% of basic materials companies. Utilities companies were most likely to include complete emissions data in their regulatory filings, with 44% of those in our sample disclosing all of their Scope 1, 2, and 3 information.

Many organizations will have to report 100% of their emissions under the SEC and ISSB rules. This means disclosure laggards will have to rapidly up their game. The SEC is due to publish its finalized disclosure rule by the end of this year, while the consultation period for the ISSB’s standards came to an end on July 29. Time is ticking.

How Manifest Climate can help

Our Climate Risk Planning solution combines cutting-edge technology, an industry-leading database of climate disclosures, and ongoing support from climate experts to deliver best-in-class climate guidance at scale. We can help your business benchmark its emissions disclosures relative to peers and industry leaders, and provide expertise to enhance and improve your overall climate reporting. Request a demo to learn more.