Portfolio carbon disclosures and targets have come to Wall Street, but good luck trying to compare them

It’s boom time for professional number crunchers. Banks’ growing appreciation of climate risks has pushed many to scrutinize their financed emissions, which are those attributable to their portfolio assets. This in turn is nourishing a whole new field of non-financial analysis — carbon accounting.

Those adept at totting up the CO2e (carbon dioxide equivalent) of loans and investments will find themselves in demand as the number of firms pledging to calculate and disclose their financed emissions increases. Auditors, consultancies and other financial institutions — particularly members of climate alliances like the Net Zero Asset Managers Initiative — will need platoons of carbon accountants to verify the fresh cascade of numbers pouring out of Wall Street offices.

These carbon-counters will also be pushed to track each bank’s financed emissions against their public targets, and evaluate their ‘carbon performance’ — in other words, their progress de-polluting their portfolios. This performance can be assessed across two dimensions: how well each bank is doing decarbonizing their portfolio relative to its peers, and how well each is decarbonizing relative to the goals of the Paris Agreement.

Carbon performance is not just a way to rank lenders by their ‘greenness’, though. For bank investors it is essential for understanding the relative climate transition risks carried by their investees. Bank clients should also care about carbon performance, as it can teach them how to adjust their climate plans to align with their lenders’ financed emissions trajectories. After all, banks are hinting that they may drop clients that don’t do enough to transition to net zero. Just this week, Citi chief Jane Fraser wrote that “clients exits” would take place “as a last resort” if efforts to bring them in line with net zero fail.

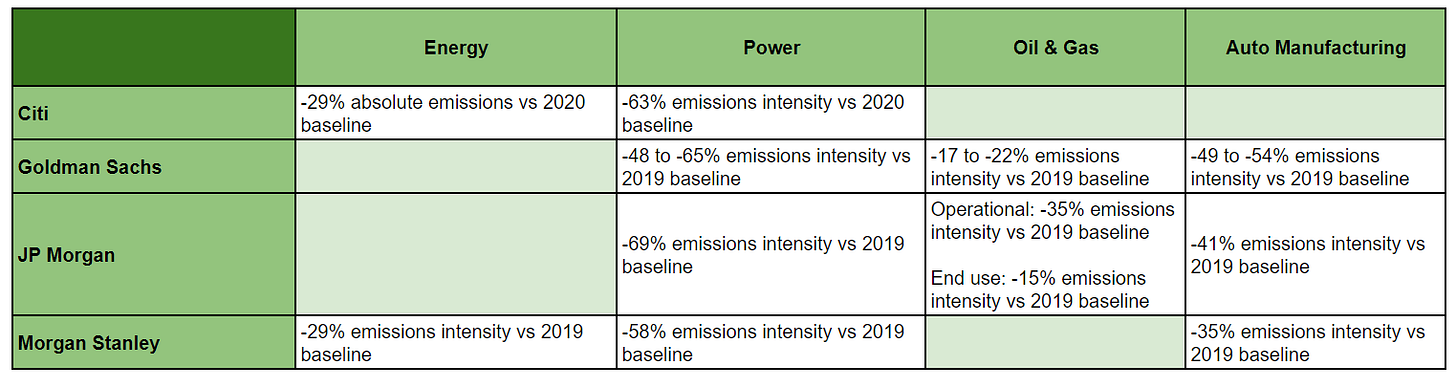

However, comparing different banks’ carbon performance may prove an analytical nightmare. This is because each firm has its own financed emissions target(s), based on their own CO2e metrics, covering its own subset of portfolios. A comparison of the 2030 financed emissions targets of four of the biggest US banks illustrates this all too well:

Source: Citi, Goldman Sachs, JP Morgan, Morgan Stanley

Which bank has the most ambitious targets? Which is most closely aligned with the goal of net-zero emissions by 2050? Is Citi’s -29% absolute emissions target more or less challenging to achieve than Morgan Stanley’s -29% emissions intensity target? It’s not clear from this data alone.

The above table actually understates the challenge facing carbon accountants.

For one, it does not show how the banks have used different climate scenarios, with varying emissions pathways, to set these targets. In some cases, they have not even used the same scenario across portfolios. Citi, for instance, has set 2030 targets for its energy and power portfolios. However, these targets are based on two different climate scenarios — the International Energy Agency’s (IEA) Sustainable Development Scenario OECD (SDS OECD) for power, and the IEA Net Zero Emissions 2050 (NZE 2050) for energy. Each has its own emissions trajectory: the SDS maps out a pathway to the “well below 2°C” goal of the Paris Agreement, and the NZE 2050 to a 1.5°C goal (with a 50% probability).

Citi said this combination of scenarios best reflects its net-zero commitment. It claimed that the OECD component of the SDS has a sharper emissions reduction trajectory for the OECD power sector than the NZE 2050 global rate, and is therefore the more ambitious scenario for its purposes. This may be true, but each scenario’s emissions trajectories are informed by their own mix of policy assumptions, meaning the targets they are based on are not strictly comparable. This makes it hard to judge the relative ambition of each portfolio’s financed emissions target.

JP Morgan is also inconsistent in its use of scenarios. The targets for its oil and gas and power portfolios are both based on the SDS (with some tweaks applied for the former portfolio), while the target for its auto manufacturing portfolio uses the Science Based Targets Initiative’s interpretation of the IEA’s Energy Technology Perspectives Beyond 2°C scenario (ETP B2DS).

Both banks can justify their use of multiple scenarios. In Citi’s case, the NZE 2050 is a ‘whole world’ scenario, while the SDS breaks down emissions trajectories by region. Using the OECD component for its power portfolio makes sense considering that the majority of its power exposures are in the OECD countries. JP Morgan, meanwhile, said it used the ETP B2DS instead of the SDS for auto manufacturing “because IEA does not publish the detailed SDS modeling results that would be needed to derive relevant portfolio targets for the Auto Manufacturing sector”. These are valid reasons, but it does not make the task of comparing and contrasting carbon performance any easier for investors and other stakeholders.

At least Citi and JP Morgan use third-party scenarios from a well-respected source. Goldman Sachs has instead used its own ‘Carbonomics’ research to set sectoral pathways for the portfolios included in its financed emissions target. While these pathways employ the science-based carbon budgets laid out by the Intergovernmental Panel on Climate Change, the emissions trajectories they follow are “based on the costs of different technologies and approaches to decarbonization” which the banks sees “as more relevant for a financial institution that does not control the pace or direction of global public policy”. By using homebrewed scenarios, Goldman makes it difficult to judge the ambition of its targets relative to the Paris Agreement and to its peers.

The patchwork composition of the portfolios ‘in scope’ of each bank’s financed emissions targets also complicates things. For example, “capital markets activity” is excluded from Citi’s and Morgan Stanley’s in-scope portfolios, but included in Goldman Sachs’ and JP Morgan’s. This rules out an apples-to-apples comparison of the scale of their respective decarbonization ambitions. It also means that the menu of options available to each bank for cutting their financed emissions is different, too. Citi, for instance, cannot shrink its debt and equity underwriting activity in pursuit of its financed emissions target, whereas Goldman Sachs can. Investors and other stakeholders will have to find ways to compensate for these discrepancies if they want to assess these banks on a level playing field.

These are just some examples of the challenges facing the fledgling carbon accountancy profession. True, efforts to cohere financed emissions practices are underway, led by Partnership of Carbon Accounting Financials (PCAF). But it has yet to convince a critical mass of institutions of its merits, as evidenced by the fact that Morgan Stanley and Citi are members, while JP Morgan and Goldman are not.

In the absence of a universal standard all banks agree to, carbon accountants will have to devise their own methodologies to assess relative carbon performance. In this endeavor, they can build on the work of nonprofit organizations, academics, and climate activists who already have — or are in the process of developing — their own approaches to comparing financed emissions baselines and targets. Of course, no two methodologies will align perfectly, meaning the ambition (or lack thereof) of banks’ decarbonization strategies will remain “in the eye of the beholder”.

Given the seeming impossibility of properly benchmarking financed emissions, then, what should investors wanting to compare carbon performance do? One option is to try and force them all to adopt the same underlying climate scenario. That’s what the Interfaith Center on Corporate Responsibility (ICCR), a coalition of asset owners and managers, is attempting. Last month, it filed shareholder resolutions with six US banks — including Citi, Goldman, JP Morgan, and Morgan Stanley — requesting they align all financing with the NZE 2050 scenario.

It’s a blunt force strategy, but one that says a lot about investors’ perceptions of the financed emissions targets they have seen so far: that they’re not up to scratch, and a simpler way to compare and contrast carbon performance is needed.