The top five climate risk stories this week

1) Bank of England launches climate stress test

The Bank of England (BoE) kicked off its inaugural climate stress test on Tuesday after a lengthy Covid-induced delay, during which the scope and ambition of the exercise have been dramatically scaled back.

Seven bank and 12 insurer participants will subject parts of their balance sheets to three climate scenarios over a 30-year time horizon to help build a picture of climate-related risks throughout the financial system. The firms will also have to submit a qualitative questionnaire to convey their understanding and management of climate risks to the central bank.

However, though BoE official Sarah Breeden said the climate scenario analysis is “fiendishly complex”, the test parameters are more generous than those first proposed.

In 2019, the BoE said that banks should produce counterparty-level assessments for 80% of their corporate loans and project how their trading books would fare under each scenario. The final version of the exercise, though, asks banks to run counterparty-level analysis for just the 100 biggest names in their corporate portfolios, while the trading book has been excluded entirely. In December 2020, the BoE said the change in scope was in response to feedback from the financial sector saying it would otherwise be “very resource intensive”.

Still, banks will have to calculate the climate impacts to the rest of their corporate loan portfolios by sector and geography, and assess how physical and transition risks could wallop their mortgage books. Insurers will be tasked with evaluating changes in the value of their invested assets, reinsurance recoverables, and insurance liabilities.

Though the quantitative portion of the test will assume a “static balance sheet” — meaning firms won’t be able to make changes to their portfolios over the stress test horizon — they will be grilled by the BoE on the management actions they could potentially use to handle their climate exposures under each scenario.

The Bank expects to publish aggregate results by May 2022. The outputs will not be used to inform capital requirements for the participants, but will be factored into the BoE’s own approach to supervisory policy.

2) Banks should disclose Paris-aligned portfolio metrics — TCFD

Updated guidance from the Task Force on Climate-related Financial Disclosures (TCFD) recommends that banks analyse and disclose how consistent their asset portfolios are with a 2°C or lower temperature target.

The proposal seeks to promote the quantification of lenders’ transition risks, which can be roughly equated with the amount of loans and securities they hold that don’t align with the Paris Agreement. The TCFD also published a technical supplementwith best practices in portfolio alignment tool construction.

It’s part of a broader push by the Task Force to expand and improve the use and disclosure of metrics, targets and transition plans by firms. Forward-looking metrics for financial institutions, in particular, are believed to be useful for assessing how individual lending and investment decisions will help or hinder progress towards climate goals.

Last year, the TCFD ran a consultation on forward-looking metrics, finding that 43%of financial services firms are using an implied temperature rise or warming potential measure for their portfolios already. The implied temperature rise metric was one rolled out for consideration by the TCFD last year. It’s in use by leading insurers Axa and Aviva, both of which have representatives on the 31-member Task Force.

In addition to a Paris-aligned portfolio measure, the TCFD recommends that banks disclose an appropriate financed emissions metric based on the Partnership for Carbon Accounting Financials’ (PCAF) methodology. PCAF has over 120 financial institution members including Wall Street giants Bank of America, Citi and Morgan Stanley. Its standard offers banks a way to measure and disclose the greenhouse gas emissions attributable to six asset classes: equity and corporate bonds, business loans and unlisted equity, project finance, commercial real estate, mortgages, and motor vehicle loans.

The TCFD’s consultation on its updated guidance closes on July 7.

3) Green central banks overhaul climate scenarios

Banks and their supervisors have six new and updated scenarios to assess their climate-related risks and opportunities with thanks to the latest publication by the Network for Greening the Financial System (NGFS).

The scenarios, released by the club of climate-focused central banks and supervisors on Monday, include nearly 1,000 economic, financial, transition and physical variables, with detailed climate pathways at both the sectoral and regional level. The NGFS intends for these to update and replace the first batch of three climate scenarios it released in 2020.

Financial regulators may use the scenarios as the basis for climate stress tests for banks, insurers and other financial institutions. The Bank of England’s own climate stress test, launched on Tuesday, is based on the scenarios.

Writing for Central Banking, Sarah Breeden of the BoE and Frank Elderson, chair of the NGFS, said the scenarios “will be instrumental in moving the financial system towards more forward-looking and greener practices”.

There are two scenarios apiece simulating an orderly transition, a disorderly transition and a ‘hot house world’. Two of the scenarios assume net-zero emissions by 2050, a nod to how this climate target has gained traction around the world.

4) A climate ‘bad bank’ could aid phase-out of fossil assets, say activists

The European Central Bank (ECB) should consider setting up a ‘fossil bank’ to buy up financial institutions’ oil, gas and coal loans, a group of climate activist and civil society organisations argue.

In a new report, ‘Fossil assets: the new subprime?’ the group said that such an entity could purchase up to 70% of European banks’ fossil fuel assets in return for a pledge that they completely end all financial services to oil, gas and coal projects and adopt a phase-out plan for their residual holdings.

This ‘fossil bank’ would play a role similar to the ‘bad banks’ set up by firms including Deutsche Bank, Credit Suisse and NatWest in the wake of the financial crisis — providing a holding pen for the unwind of unwanted assets that is segregated from ‘good’ portfolios.

The report authors say this solution could clear the stock of fossil fuel assets from banks’ balance sheets, freeing up space for them to fund the low-carbon transition. It would also protect banks from capital-sapping losses caused by the likely drop in value of these assets over time.

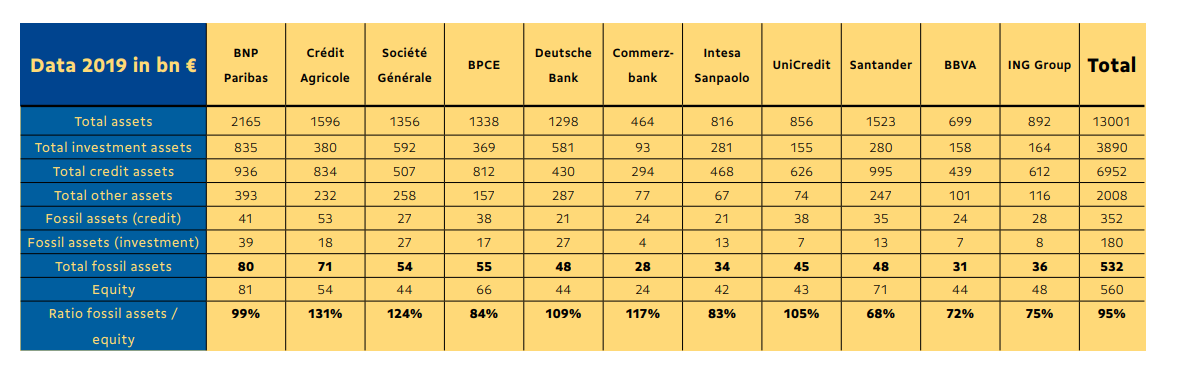

Source: ‘Fossil assets: the new subprime?’

An analysis of the 11 European banks’ portfolios by the group found that they hold €530 billion of fossil fuel assets, equal to 95% of their total equity. At Crédit Agricole, Societe Generale, Deutsche Bank, Commerzbank and UniCredit, the value of fossil fuel assets exceeds their total equity.

5) Oliver Wyman, S&P launch transition risk tool

Investors and corporations will be able to assess how over 700,000 public and private companies’ creditworthiness could be impacted by climate change using a new model suite launched by Oliver Wyman and S&P Global Intelligence.

The Climate Credit Analytics tool, released on Thursday, allows users to calculate climate scenario-adjusted financials and credit scores at the company level to learn how they’d fare under a low-carbon transition.

Swiss bank UBS said it is using Climate Credit Analytics to gauge the transition risks in its portfolio. “Partnerships such as this one that bring together the best of capabilities across data, methodologies, and analytics are critical for furthering our understanding of climate-related financial risk,” said Liselotte Arni, UBS Portfolio Underwriter for Sustainability and Climate Risk.

The tool uses climate transition reference scenarios published by the Network for Greening the Financial System, but also allows users to run customised scenarios and the ability to vary temperature targets, transition pathways and carbon pricing levels.

Climate Credit Analytics leverages S&P Global Market Intelligence’s warehouse of financial and industry-specific data together with firm-level greenhouse gas (GHG) emissions and environmental impact information gathered by S&P Global Trucost.