Our previous analysis highlighted the low level of public disclosures around materiality assessments. In this article, we explain why this is and how peer examples from public disclosures can help organizations tackle materiality assessments.

What is a materiality assessment and why do they matter?

Materiality assessments allow organizations to identify and prioritize climate material risks or opportunities based on the business impact or importance to key stakeholders. It compares climate and business risks (or opportunities) to determine where to focus risk mitigation strategies. Transparently disclosing assessment findings can justify climate risk management decisions to investors, stakeholders, and regulators, clearly demonstrating an organization’s approach to decision-making.

Given its importance, it’s no surprise that SEC and CSRD regulations mandate the reporting of materiality assessments. While the language and extent of requirements in both regulations differ, there is a clear trend towards increasingly detailed reporting requirements on materiality assessments, as seen in the table below:

| Disclosure requirement | SEC language | CSRD language |

| What’s considered material | Single, financial materiality (i.e. impact of climate risk on business. | Double materiality (financial and impact) (i.e. impact on the environment and business). |

| Processes | Description of assessment process for material risks. | Description of how materiality was determined including if any materiality thresholds. Specifically, how the organization implemented materiality assessments and how this is necessary to identify material risks and opportunities reported. |

| Prioritization | Indication of prioritization that determines whether to address the risk. | Overview of processes to identify, assess, and prioritize, and monitor potential and actual impacts, informed by the undertaking’s due diligence process. |

| Likelihood and magnitude of risk | Whether it has incurred or reasonably likely to incur a material physical or transition risk. | Disclose how the organization assesses the likelihood, magnitude, and nature of effects of the identified risk and opportunities. |

Why are disclosures for materiality assessments low?

Organizations may not always be inclined to show the math behind how they determined material risk or opportunity, as it can open them up to scrutiny and questions. A materiality assessment deemed inaccurate could expose the organization to legal action from investors for providing misleading information in disclosures. The results of a materiality assessment exercise may also differ from year to year, creating uncertainty around what the right material topics are for an organization.

How can organizations improve materiality assessment disclosures?

Clear and transparent explanations on how the materiality assessment was conducted, how frequently it is conducted can mitigate these fears. Other helpful details that enable transparent and credible disclosures include the assessment processes, time frames considered, stakeholder input or business impacts factored, and the assumptions used to arrive at these findings.

Peer and industry reporting on materiality assessment can provide a benchmark for what good or complete disclosure looks like. Such examples can provide a jumping-off point to an organization’s own definitions around materiality, and material climate risks or opportunities that should be in their radar. Best-in-class disclosures also provide a direction for continuous improvement around the way materiality assessment exercises are conducted.

Using peer examples to identify good assessment disclosure

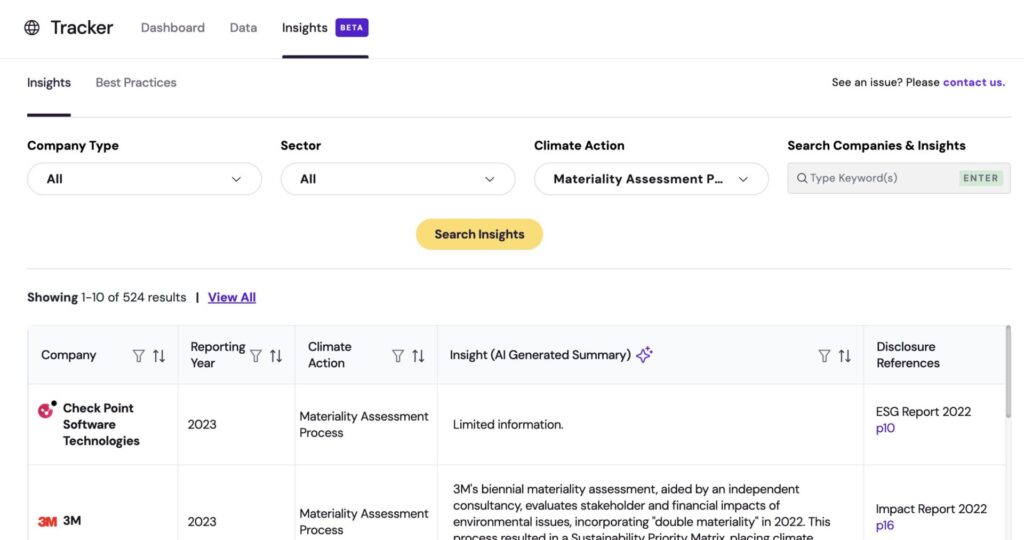

Manifest Climate’s newest ‘Insights’ feature opens up access to its entire database of peer examples. Insights uses Manifest AI models to generate short, accurate, and clear summaries of an organization’s climate disclosures, including materiality assessment. These summaries allow customers to quickly sift through and identify relevant and good peer examples. Clicking on the page hyperlinks will direct users to the exact source of the disclosure so they can examine the language and detail.

Manifest Climate customers can use filters on Insights to look for sector-specific examples and any examples from their custom benchmark companies. Clients can also use keywords to look for specific references, e.g. around materiality matrix, or heat maps for risks.

The below list highlights good examples of materiality assessment disclosures surfaced by Manifest Climate’s Insights and Best Practices features.

Disaggregation of climate risks

Organizations’ materiality assessments may include a wide range of business risks, including climate. However, organizations grouping all physical and transition risks into a broad climate risk bucket may miss out on important differences in the impact and exposure that can determine which is more material.

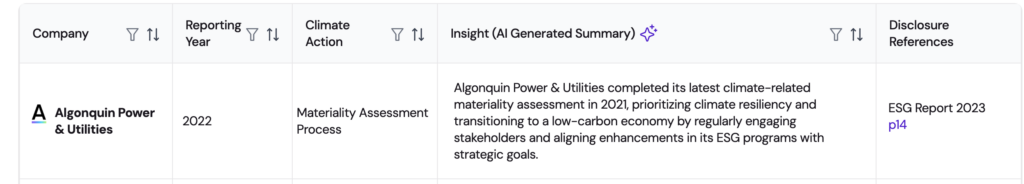

Insight: Page 14 of Algonquin Power and Utilities’ 2023 ESG Report shows how their materiality matrix specifies climate risks like GHG emissions, the low-carbon energy transition,

climate resilience and energy efficiency that each score differently on their materiality matrix.

Comprehensive coverage of impact factors

Climate risks and opportunities have varying impact on operations, long-term strategy, financial conditions, and may impact various stakeholders like investors, clients, employees and other counterparties differently. Therefore, organizations must define and cover a comprehensive set of impact factors, or engage with a wide set of stakeholders, to determine the significance of each climate risk or opportunity.

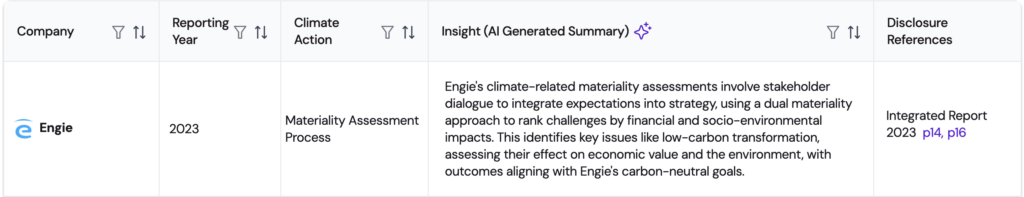

Insight: On page 14 of Engie’s 2023 Integrated Report, the materiality matrix considers both importance to stakeholders and value creation for Engie to determine material topics.

Insight: Page 4 of Air France KLM’s 2022 Sustainability Financing Framework highlights how they consider input from a wide variety of internal and external stakeholders.

Explaining the process behind materiality assessment

Apart from reporting the findings of an assessment exercise through a materiality matrix or heat map, disclosing how the organization arrived at these findings is equally important. Helpful details on process include who was consulted for the assessment exercise, what steps were followed, and how impact to the firm’s business and strategy was determined.

Further, it would be helpful to divulge how recent or how often the organization conducts the assessment. Repeating the assessment exercise annually can help organizations adjust or pivot their risk management strategies in a timely and effective manner.

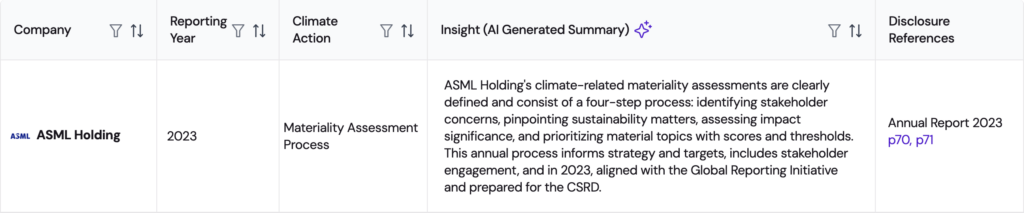

Peer Insight: Page 72 of ASML’s 2022 Annual Report provides an overview of how they conducted their materiality assessment. Page 71 of ASML’s 2022 Annual Report highlights the changes in material topics between consecutive years of conducting this exercise.

Conclusion

Investors and regulators are increasingly demanding material climate-related information in disclosures. But a disclosure on material climate risks and opportunities rings hollow if it is missing an explanation on why and how the organization came to conclusions of materiality or non-materiality. Regulators will increasingly expect from organizations a thorough description of materiality assessments – one that compares specific climate risks against other business risks – and how the findings impact firm strategy. This information helpfully justifies strategic and risk management decisions and assures that the organization is staying on top of key climate risks and opportunities.

The relatively low inclusion of materiality assessment disclosures today however is a reminder that organizations are wary of excessive scrutiny for showing the math behind their work. Using sector and peer disclosure examples can help organizations find the right balance and language to guide their disclosures and identify best-in-class practices to design future assessments.

See Manifest Climate in action

Manifest Climate is the leading Climate Intelligence Software that provides decision-makers with climate-related insights and recommendations to inform decisions, seize opportunities and mitigate risk.

Manifest Climate uses industry-leading AI models to create comparability from qualitative climate information faster, more accurately and more consistently than humans.

Issuers, service providers and financial institutions choose Manifest Climate for ease of use, in-house climate expertise, and depth of qualitative climate data.

With Manifest Climate, teams reduce time spent on manual research by 99%, improving precision and consistency as a result.