Many financial institutions have rolled out portfolio decarbonization goals. But the differences between them could be ‘gamed’ by carbon-intensive companies

Net-zero target setting is all the rage in the financial sector. In recent weeks, four of the five largest Canadian banks have rolled out targets for select portfolios, while the laggard — Royal Bank of Canada — has promised to release its own shortly. Wall Street has also jumped on the bandwagon, as have top lenders in the UK and European Union.

The problem is that each bank’s targets are different, in that they cover various combinations of portfolios, metrics, and activities, and are anchored to disparate climate scenarios. This makes assessing the ambition and credibility of targets against one another challenging. It also opens up opportunities for carbon-intensive companies to exploit these differences, and continue to receive financing without fundamentally changing their activities.

This kind of ‘target arbitrage’ could widen the delta between the rate of change of financial institutions’ portfolio emissions and real-world emissions — an outcome that may flatter banks’ and asset managers’ carbon balance sheets but do little to curb climate change.

This risk hasn’t escaped the notice of climate advocacy groups nor financial regulators. Just last week, Sarah Breeden of the Bank of England said that external attention on individual institutions may incentivize them to “green” their own balance sheets at the expense of the economy at large. In March, UK think tank InfluenceMap revealed that although 29 of the 30 largest publicly listed financial institutions have committed to net-zero portfolio emissions by 2050, none have fossil fuel financing policies aligned with credible net-zero scenarios designed by the International Energy Agency (IEA) or Intergovernmental Panel on Climate Change (IPCC).

Fortunately, work is underway to quash target arbitrage and strengthen the link between financial institutions’ net-zero targets and real-world emissions reductions. On Wednesday, the Science-based Targets Initiative (SBTi) released a “foundations paper” with “principles, definitions, metrics, and target formulation considerations” to help financial institutions “set quantitative net-zero targets linked with emissions reductions in the real economy.”

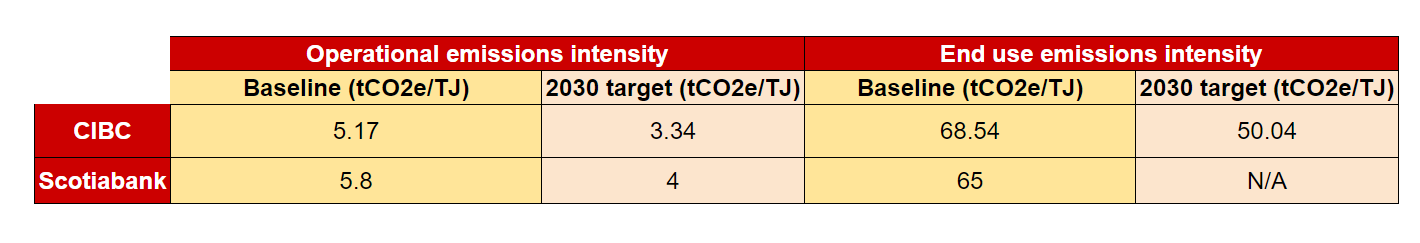

First, a look at how target arbitrage may work in practice. Take the oil and gas portfolio targets set by two Canadian banks. CIBC set a 2030 decarbonization target on March 31, which requires it to cut the operational emissions intensity (Scope 1 and 2 emissions) of its portfolio by 35% versus a 2020 baseline. The operational emissions target is 3.34 grams of carbon dioxide equivalent per megajoule of fuel (gCO2e/MJ) produced, the equivalent of 3.34 tonnes per terajoule (tCO2e/TJ). These targets are aligned with the IEA’s Net Zero by 2050 (NZE) pathway.

Scotiabank published an oil and gas target as part of its net-zero pathways report on March 15. Its 2030 target for operational emissions intensity is around 4 tCO2e/TJ— a higher intensity threshold than that adopted by CIBC (albeit from a higher baseline). However, like CIBC it claims this target is aligned with net zero by 2050. What explains the discrepancy is Scotiabank’s choice of climate scenario. Instead of the NZE, it uses the Canadian Government’s Evolving Oil and Gas Pathway to inform its target.

CIBC’s and Scotiabank’s oil and gas financed emissions targets

Source: CIBC, Scotiabank

The basis between these two targets means that an oil and gas company with an operational emissions intensity of 3.7 tCO2e/TJ, and no plan to lower this by 2030, would likely be rejected by CIBC for being misaligned with its target — but be welcomed with open arms by Scotiabank. This could lead to a situation whereby oil and gas clients are shuffled between the two lenders, allowing both banks to claim financed emissions reductions while real-world emissions remain the same. Of course, other factors — like the weighting of each bank’s portfolios between high- and low-emitting clients — could limit this somewhat. But the opportunity for arbitrage is undeniably there.

There are other net-zero target bases that carbon-intensive companies could take advantage of. ‘Scope of emissions’ is one. For example, CIBC has set a -27% end use emissions (Scope 3) intensity target for its oil and gas portfolio, while Scotiabank has not, citing the “absence of reliable, quality client Scope 3 data.” An oil producer that has low operational emissions intensity but high end use emissions intensity may be pressured to reduce the latter by CIBC, but not by Scotiabank — so long as the latter lacks a Scope 3 target.

Then there’s the ‘scope of activities’ basis, which manifests within banks as well as between them. Certain lenders set targets only for their lending and investing portfolios, whereas others include capital markets activities, like debt and equity underwriting. UK bank HSBC took heat from campaign group ShareAction in February for initially limiting its net-zero target to on-balance sheet exposures, despite the fact that around 60% of its financing of top upstream oil and gas companies is in the form of underwriting.

This presumably meant that a carbon-intensive oil client of HSBC’s could remain a customer, and be free from pressure to transition, so long as it swapped its loan financing for debt financing. Following investor pressure, HSBC promised to expandthe scope of its target to encompass capital markets activities. However, plenty of other banks continue to maintain targets narrowly focused on their loan and investment portfolios.

How could the SBTi help abolish target arbitrage? The foundation paper is not a checklist of items firms can follow to produce high-quality net-zero targets. Instead, it provides “clarity on key concepts” around target setting — acting as a roadmap, of sorts. It includes four “guiding principles” to ensure targets “lead to a state compatible with achieving a net-zero economy by incentivizing and driving the action needed to meet societal climate and sustainability goals.”

The first principle is “completeness.” This states that targets should cover all relevant operational and financing activities of an institution, and portfolio companies’ Scope 1, 2, and 3 emissions. Adherence to this principle would eliminate the ‘scope of emissions’ and ‘scope of activities’ arbitrages discussed above.

The second principle is “align financing with most recent climate science.” This says that financial institutions should decarbonize their lending, investing, and capital markets activities “in line with pathways that achieve the goal of the Paris Agreement to limit warming to 1.5°C with no or low overshoot.” Though the SBTi does not list eligible pathways, it cites the P1 and P2 pathways of the IPCC’s special report on 1.5°C as examples.

This principle has the potential to crush the target arbitrage caused by scenario selection and prevent carbon-intensive companies from switching between lenders to avoid transitioning — but it’s not a sure thing. For example, although the Canada-specific pathway Scotiabank is using for its oil and gas target does not have a specified temperature ambition, it does target net-zero emissions by 2050. Does this mean it adheres to the SBTi’s principle? It could be argued either way. A stronger principle would be to insist that a portfolio target be anchored to the IPCC P1 or P2 pathways (or an equivalent, like the IEA NZE) if it is to be considered ‘net-zero aligned.’

The third principle says that targets should “help achieve economy-wide decarbonization and a just transition, and not simply reduce portfolio exposures to GHG emissions.” This is a call for financial institutions to engage with their clients/investees so that they transition to net-zero — irrespective of the structure of their portfolio targets.

Returning to the above example of the oil client with a 3.7 tCO2e/TJ operational emissions intensity, while Scotiabank may not have to pressure them to decarbonize for its portfolio target’s conditions to be met, in order to align with the SBTi principle the bank would have to engage with them to cut emissions below this baseline — otherwise it could not claim to be driving real-world emissions reductions.

The final principle says financial institutions should promote the financing of decarbonization efforts and of “climate solutions” — like renewable energy and carbon capture technologies — as part of their net-zero targets. Most banks and other financial firms already have ambitious sustainable finance goals in place, but these are often decoupled from their portfolio emissions reduction plans. Indeed, these goals are sometimes framed as a reaction to customer demand or as an effort to capitalize on nascent markets, rather than as part of an institution’s broader portfolio decarbonization strategy.

What the final principle seeks to prevent are banks training their financial firepower solely on fossil fuel phase-out activities and neglecting green technologies — or vice versa. It should also work to bind sustainable finance and net-zero target efforts more closely together within institutions, which could lead to more coherent and effective transition planning. In turn, this could take care of another form of target arbitrage, whereby carbon-intensive clients use the finance received from institutions solely to cut their emissions over the short-term instead of investing in long-term green solutions.

The SBTi foundation paper represents the organization’s first step on the road toward a new standard for net-zero target setting in the financial sector. What’s unknowable today is whether this prospective standard will be adopted en masse when it’s finalized. The Net-Zero Banking Alliance (NZBA) could act as a vehicle for the standard, considering the parallels between the group’s commitment statement and the SBTi’s principles. On the other hand, a likely reason for the NZBA’s success gathering members to date is its very lack of prescriptiveness. Incorporating an external standard may rub some members the wrong way.

Ultimately, a standard is only as effective as the powers enforcing it. But regardless of the SBTi’s success with its net-zero target setting efforts, it has already helped propagate principles that can be used by financial institutions, their investors, and other external stakeholders to knock out target arbitrage and ensure no carbon-intensive company is able to avoid making a low-carbon transition.