Increasingly, large public organizations are shifting their climate disclosure focus from the Task Force on Climate-related Financial Disclosure (TCFD). Since its release in 2017, the TCFD has been a mainstay of climate risk reporting. However, the formation of the International Sustainability Standards Board (ISSB) and the release of its reporting standards, IFRS S1 and IFRS S2, has led many companies to shift focus from the TCFD to the ISSB standards for climate risk disclosure.

But rather than representing ‘yet another’ change in the climate disclosure landscape, the shift from the TCFD represents an evolution — and its widespread adoption should be positive for companies, consumers, and shareholders alike.

What is the ISSB?

In November 2021, the IFRS (International Financial Reporting Standards) Foundation announced that it would form the International Sustainability Standards Board (ISSB) to develop centralized standards for climate disclosure reporting. The new standards build on the TCFD and effectively consolidate existing sustainability reporting standards, such as Climate Disclosure Standards Board (CDSB) (established by the CDP) and the Value Reporting Foundation (VRF) (established by the Sustainability Accounting Standards Board (SASB) and the International Integrated Reporting Council (IIRC) for consolidation purposes).

In June 2023, the ISSB published its inaugural disclosure rules, which are intended to become the global climate and sustainability reporting baseline. These rules are the IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures (the latter adopting many features of the TCFD).

Internationally, the ISSB is likely to become a mainstay of climate reporting. Individual countries may adopt the ISSB standards with some modification, and certain jurisdictions may continue to employ their own rules (e.g. Europe and, likely, the US), but it is fair to say that a company that follows the ISSB approach will be well set up for increasing disclosure regulation around the world.

Companies can choose to disclose voluntarily beginning in 2024, but some countries may leverage the ISSB standards for their mandatory disclosure requirements, meaning that many companies will be required to report against ISSB standards in the future.

Why companies are choosing ISSB over TCFD

The ISSB has taken the role of the ‘centralized authority’

Part of the reason many companies are moving toward the ISSB standards is because of the popular recognition of the IFRS and, by extension, the ISSB as a central figure in public company reporting.

The release of its first standards positions the ISSB as a primary authority on climate-related disclosures, and signals a transition away from the TCFD. This shift was further highlighted when the Financial Stability Board (FSB) — which created the TCFD — recently requested that the IFRS Foundation, the parent organization of the ISSB, assume responsibility for monitoring corporate progress on climate disclosures.

Investors want even more information

Going the extra mile to comply with the ISSB will help public companies better meet their investors’ expectations. This is because the ISSB requires the disclosure of detailed information to improve investor decision-making, and provides extensive guidance for those tasked with making such disclosures. The TCFD is a highly respected disclosure framework, and the IFRS S1 and S2 build on its recommendations to give a more complete and thorough picture of a company’s climate and sustainability risk management.

The ISSB will improve standardization and transparency

More companies reporting to the ISSB’s detailed and standardized disclosure frameworks — which integrate the TCFD recommendations — will reduce confusion and complexity, both for the company, which will find cross-jurisdictional reporting far simpler, and for stakeholders, who will have better means of comparing sustainability and climate data across organizations.

The TCFD acts as a helpful starting point

The ISSB standards incorporate the existing recommendations of the TCFD, which means that companies already aligning to the TCFD recommendations are starting from a strong place when they turn their attention to the ISSB.

How to transition from TCFD to ISSB

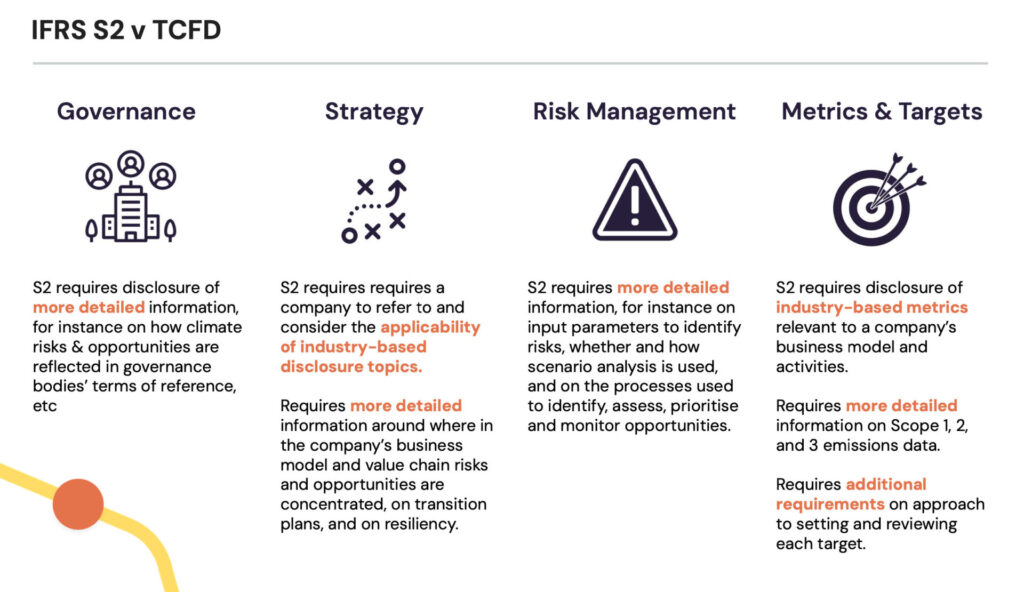

The first step in transitioning from the TCFD to the ISSB is identifying what the ISSB requires in climate-related disclosures, and how this differs from the TCFD’s recommendations. Identify which areas of IFRS S2 can’t be satisfied with your existing TCFD disclosures and make an action plan for addressing them.

Helpfully, the IFRS offers a comparison table between IFRS S2 and the TCFD to allow companies to quickly identify gaps at a high level. To get you started, use Manifest Climate’s disclosure alignment to reveal where you’re falling short against the IFRS S2, and to understand what your investors are really looking for on climate-related disclosures.

For many companies, it’s not just a case of identifying data and disclosure gaps. Effecting changes in governance and risk management practices are often required to shore up a company’s resilience to the effects of climate change, and to ensure disclosures satisfy investor demands for climate management.

Additionally, you may need to adjust the timing of your disclosures, particularly if you currently do not disclose climate data at the same time as your financial statements. IFRS S1 requires that companies disclose sustainability data at the same time as their financial statements, although this requirement is waived in a company’s first year of reporting.

Still stuck on TCFD vs. ISSB? Manifest Climate can help.

Manifest Climate is a climate framework and disclosure management solution that helps companies supercharge their climate strategies. Our platform is the world’s best at assessing climate disclosures. We help to highlight your climate disclosure and management gaps across multiple standards and frameworks and provide data-driven recommendations for improvement. Our technology also helps your team save up to 75% in manual effort and up to 50% in compliance costs.