A growing trend in the market amongst climate-aware institutional investors is a commitment to align their investment portfolios with the Paris Agreement, and contribute towards the goal of net-zero global emissions by 2050.

To help investors achieve these objectives, the Institutional Investors Group on Climate Change’s (IIGCC) Paris Alignment Investment Initiative, supported by 70 European investors with USD $16tn in assets, has released a draft Net Zero Investment Framework (The Framework). The Framework builds on existing climate-related practices to create an organizational strategy focused on two objectives: reducing the emissions associated with investment portfolios, and increasing investment in climate solutions that mitigate emissions in the real economy.

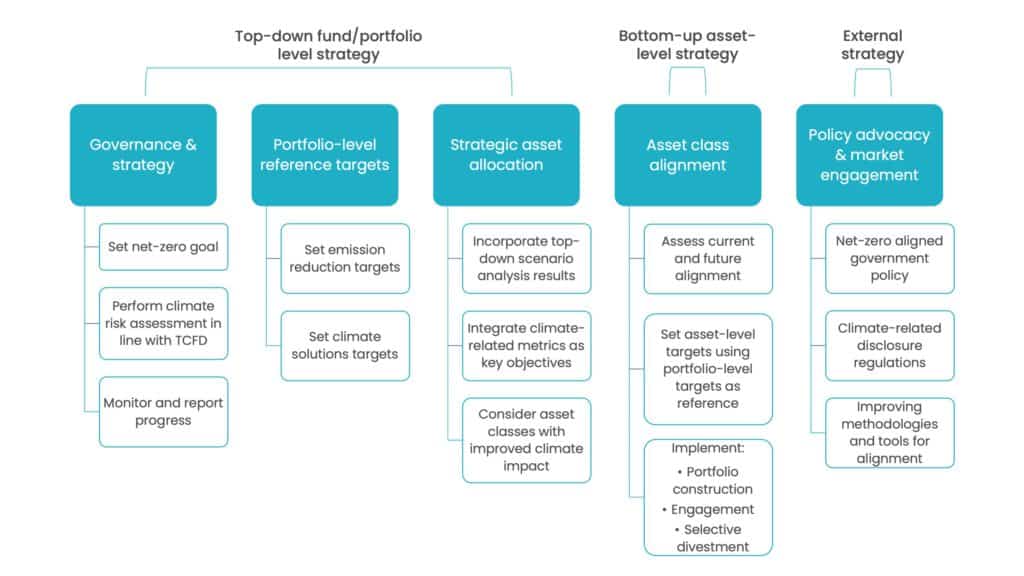

To date, many climate-aware investors have integrated aspects of a bottom-up approach that only focuses on integrating climate change into individual investment decisions (e.g. using climate-related metrics to compare companies within a sector or subsector). The new Framework, however, suggests integrating climate change as a theme across the entire investment process using a top-down investment strategy in combination with bottom-up analysis.

Five components of a net-zero investment strategy are presented in The Framework. These include governance and strategy, portfolio-level targets, strategic asset allocation, asset class targets and alignment criteria, and external engagement with various stakeholders. Listed equities, corporate and sovereign bonds, and real estate covered within the asset class alignment component.

Net Zero Investment Framework

Source: IIGCC

The IIGCC is working with five large investors to test its application on real-world portfolios and the findings will be published in the final version of The Framework before the end of 2020.

Some of the novel actions recommended within The Framework are a significant step forward in integrating climate change into investment practices. These actions, however, will require significant commitment, conviction, and resources from investors to implement. Support will be needed from financial markets and other financial industry groups to join investors on the journey to net-zero alignment. Our top four takeaways cover both these bold new recommendations and identifies gaps in the industry’s ability to implement them.

1. Integrating climate considerations into strategic asset allocation puts investors into new territory

The Framework recommends adding climate change considerations at a much earlier stage in the investment process. The result would be a shift in how portfolios are initially constructed, possibly leading to outcomes such as increased allocations to illiquid renewable energy infrastructure assets.

The recommendations presented for the asset allocation process include: performing macro-level climate scenario analysis to inform return expectations for asset classes, as well as adding portfolio-level targets for carbon intensity and percentage invested in climate solutions as key objectives alongside standard risk/return indicators.

These are new concepts that will require significant commitment by investors to implement. Strategic asset allocation relies on backward-looking data to forecast future risks and returns, and the forward-looking nature of climate change will challenge this viewpoint and investors’ mindsets on portfolio construction.

2. A shift away from mainstream benchmarks looks to be in order, but index providers have work to do

Another key role of an asset allocation process is to define the benchmarks investors use to measure and assess their strategy’s performance and define an investment universe. While investors have begun to adopt benchmarks and indexes that use climate-related criteria to adjust their weightings, The Framework highlights the importance of this goal across all asset classes to achieve overall Paris alignment.

The Framework acknowledges that currently, there are no constructed benchmarks and indexes that consider a company’s Paris alignment and transition potential across all sectors and regions. This reduces an investors’ ability to impact emission reductions across the wider real economy and achieve the required diversification. The EU has recently established EU standards for Paris-aligned benchmarks, however these standards are focused on constructing benchmarks with a 50% reduction in GHG emission intensity versus the parent, market-weighted benchmark. As a result, these benchmarks exclude certain sectors and regions making them unsuitable at scale for large investors.

Investors will be required to engage index and data providers to construct indexes that incorporate the alignment and transition criteria set out by The Framework for each asset class.

If done at scale by institutional investors, this shift from conventional benchmarks could create a large impact across financial markets by incentivizing companies and other issuers to align with a net-zero ambition.

3. Taxonomies will play a critical role in finding climate opportunities, but more of both are needed

To accomplish real economy emissions reductions, in combination with portfolio reductions, The Framework highlights the need for investors to set portfolio-level and asset class-level targets to increase their allocations towards climate solutions.

The Framework recommends investors use the definitions for climate change mitigating economic activities outlined by the EU Taxonomy to help identify climate solutions. The EU Taxonomy is a useful tool, but reporting against it will only be required by large listed EU companies. The burden is on investors to determine their investments’ alignment with the EU Taxonomy, and investors will need better disclosure and more taxonomies across other jurisdictions to help identify Paris-aligned opportunities for their global portfolios.

Investors will also need access to more suitable investment opportunities that achieve climate mitigation outcomes in the real economy. Morgan Stanley recently performed an analysis of 1,300 European companies, finding that only 100 companies had revenues which were eligible under the EU Taxonomy. If investors can build large scale demand for climate solutions, aided by the shift towards climate-tilted benchmarks, a strong signal can emerge regarding the availability of capital for net-zero aligned companies and projects. The potential for increased valuations and reduced cost of capital could be the necessary incentives to drive the market to create more opportunities for investors.

4. A net-zero strategy could be difficult for smaller investors to implement

The Framework would require significant internal resources and direct influence over investment decision-making to implement, meaning it is likely more effective for larger asset owners who employ in-house investment teams and can create specific investment mandates with their asset managers. Smaller investors will rely heavily on their asset managers to incorporate aspects of The Framework under existing strategies, as well as requiring the institutional investment product market to expand its offering of Paris-aligned investment products.

In addition, smaller asset owners may be faced with an inability to invest in illiquid asset classes, such as direct investment in renewable energy infrastructure, and limited resources to cover the governance costs associated with measuring, monitoring and reporting on their alignment.

At minimum, smaller asset owners will be able to incorporate some aspects of The Framework, such as joining industry collaborations seeking ambitious government policies and disclosure regulations and integrating climate change capabilities into their asset manager selection process. As large investors embark on this journey, their demand for Paris-aligned investment products will hopefully blaze the trail for smaller investors to follow.