The final recommendations of the industry-led Financial Stability Board (FSB) Task Force on Climate-related Financial Disclosure (TCFD) are continuing to gain momentum and attract support from companies, investors, rating agencies, stock exchanges, regulators, governments and others. Companies across sectors are endorsing the recommendations and some are beginning to implement them in their public disclosures. Global asset managers such as BlackRock and Vanguard are also pushing for increased uptake of the recommendations. While the TCFD recommendations are technically voluntary, market expectations are changing such that understanding and disclosing material climate-related risks and opportunities is no longer optional.

Supporting companies

The TCFD recommendations have been well-received by businesses and investors from around the world. 237 companies with a combined market capitalization of over $6.3 trillion USD have now made their support public for the voluntary recommendations. These hail from a broad range of industries including energy, mining, transport, financial services and consumer goods, among others. Eight of the ten largest asset managers are amongst the supporters, including investment management giants BlackRock and State Street. In fact, BlackRock just announced that it is sending letters to companies in its portfolio, urging them to take up the TCFD recommendations. It is targeting companies that it believes have “material climate risk inherent in their business operations”, namely those in the energy, transportation and industrial sectors. These actions set an excellent example and demonstrate leadership in advancing climate-related disclosure in the investment community.

The accounting profession is also recognizing the important roles they can play in climate change-related issues. The Prince’s Accounting for Sustainability Project has convened 34 CFOs, 12 CEOs of accounting bodies and 14 chairs of pension funds to affirm their commitment to support and work towards adoption of the TCFD recommendations through their statement of support. CFOs from leading Canadian organizations are on that list, including the City of Vancouver, The Co-operators Group Ltd., Manulife, WSIB and Telus.

TCFD implementation to date

Organizations are beginning to implement the TCFD recommendations – that is, they are using the TCFD framework for disclosing climate-related information. Those showing early-adoption and disclosure include BHP, Australia and New Zealand Banking Group (ANZ), and Royal Bank of Canada (RBC).

BHP, a leading global resources company headquartered in Australia, applied the framework in its 2017 Annual Report. BHP’s Annual Report referenced climate change information already available in other public documents, which allowed the company to take stock of and consolidate its existing climate-related disclosures in its mainstream financial fillings (as opposed to making new climate-related disclosures). This approach demonstrates the first steps a company might take in implementing the TCFD recommendations.

ANZ was the first bank in the world to use the TCFD recommendations for climate-related disclosure and integrate it into their 2017 Annual Report. The disclosure points to ANZ’s overarching business approach to climate as outlined in ANZ Climate Change Statement where ANZ declares its support for regulatory move around the world in an effort to limit the average global temperatures rise to no more than 2°C above pre-industrial times. The bank stated that its most material climate change risks and opportunities result from its lending business.

RBC recently released a Climate Change Position & Disclosure Statement for 2017, responding to the recommendations of the Task Force on Climate-related Financial Disclosures. The Position Statement acknowledges climate change as one of the most pressing issues of our time and recognizes the potential widespread impacts on various sectors of the economy, including those in which the bank and its clients operate.

RBC is one of the first banks in Canada and the world to disclose climate-related information using the TCFD framework. While RBC’s climate-related disclosure is still in its early stages and is fairly high level, it demonstrates global leadership and positive progress towards enhanced transparency on climate risk and opportunity, as well as alignment with the TCFD recommendations.

Further spotlight on banks

While some banks, including those under the UNEP FI TCFD pilot project, issued climate change position statements similar to RBC, they have not yet applied the TCFD framework to their climate-related disclosures. HSBC has indicated that the governance, strategy and risk management recommendations of the Task Force will be available in its 2017 annual report that is planned to be published in February 2018. A prominent Australian bank, Commonwealth Bank (CBA), has also promised to adopt TCFD recommendations for disclosure of climate-related information in its Climate Policy Position Statement. This announcement came one week after its shareholders filed the world-first lawsuit against the bank due to a failure to inform its investors on risks posed by climate change in its 2016 annual filings. The lawsuit was dropped following CBA’s issuance of its 2017 Annual Report, where it promised to assess climate risk on its business operations.

Implementation path

The TCFD recommendations are meant to provide companies and investors the data needed to accurately measure climate risks, evaluate opportunities and identify which investments will yield solid returns. The announcements described above demonstrate a promising start to the widespread adoption of the TCFD recommendations and better understanding and disclosure of climate-related information.

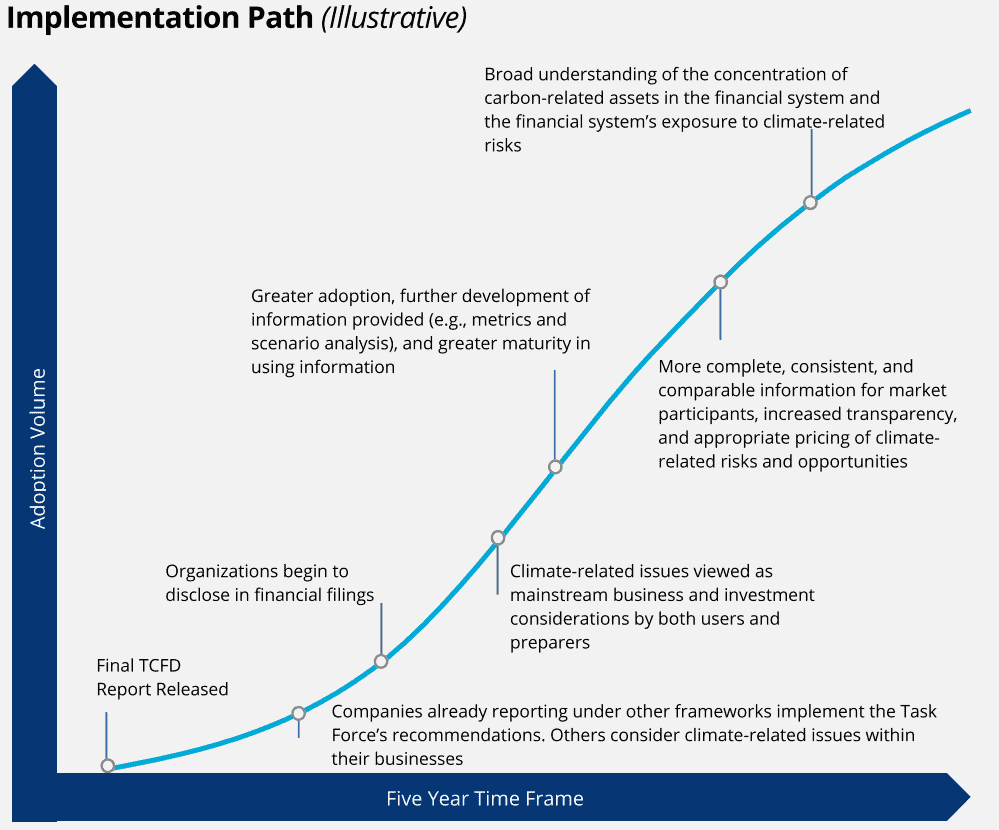

But of course there is still more work to do. The TCFD itself has indicated that it will take approximately five years for companies to properly implement the recommendations, just released this past June 2017, and meaningfully integrate them into their reporting. Indeed, the chart below outlines a timeline of what a meaningful response would entail.

Source: Final Report: Recommendations of the Task Force on Climate-related Financial Disclosures, TCFD, June 2017

Next steps will include more robust climate risk assessments, scenario analyses and strategy development at the company level to better inform public disclosures.

We will continue to track support for and implementation of the TCFD recommendations by companies in Canada and around the world and look forward to continuing developments in this space. Greater understanding and transparency around climate-related risks and opportunities is a key step towards accelerating the transition to a low-carbon economy and ensuring global financial stability.