This blog is based on a webinar hosted by Kevin Quinlan, Climate Strategist at Manifest Climate, in conversation with Dr. Blair Feltmate, Head of the Intact Centre on Climate Adaptation

Climate change has surfaced two types of risks: transition and physical. The former relate to those actions taken to reduce the greenhouse gas (GHG) emissions that cause planet-wide warming, while the latter concerns those changes in weather and climatic conditions triggered by this warming.

Physical risks can be classified into two categories: acute and chronic. Chronic risks unfold over time as the result of long-term changes to the earth’s climate. Examples include sea-level rises, higher temperatures, and changes in precipitation patterns.

Acute risks relate to extreme weather events, which will occur with increased frequency and severity as climate change progresses. Examples of acute risks include floods, droughts, and wildfires.

Both acute and chronic risks could hit businesses with financial losses, and climate science shows that the current level of warming has already guaranteed that these physical risks will become only more intense and devastating over time. In August, the UN Intergovernmental Panel on Climate Change itself confirmed this, in a report which said that climate change is making “extreme climate events including heatwaves, heavy rainfall and droughts more frequent and severe today and in the future”.

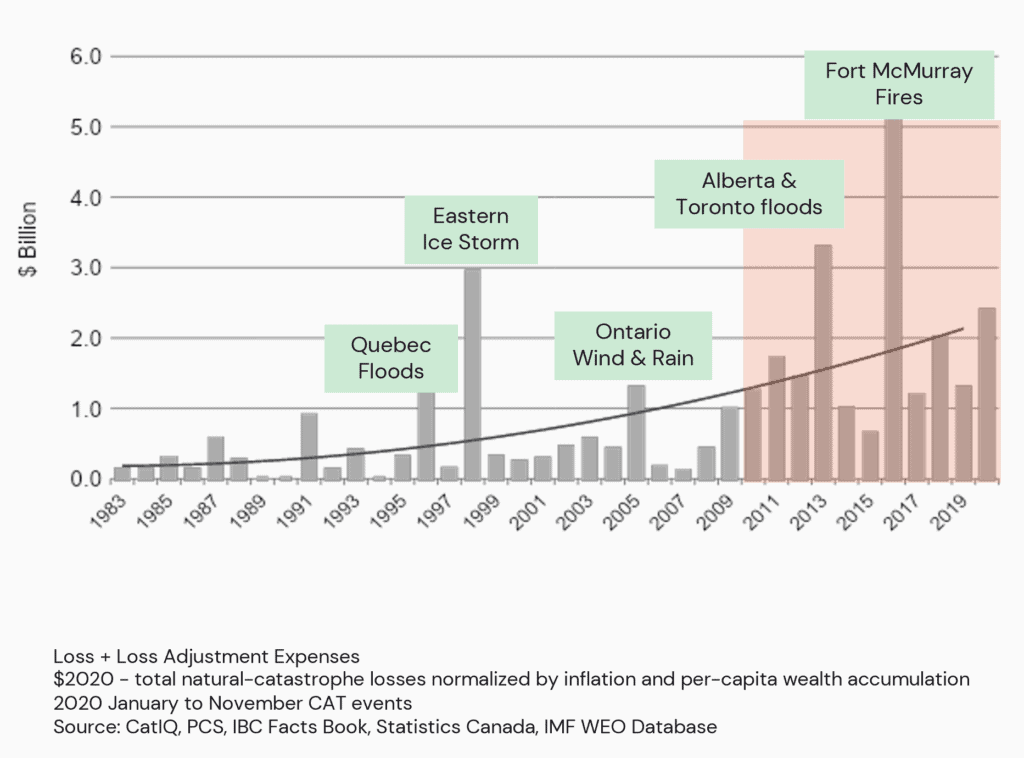

The composition of physical risks will vary from country to country. In Canada, insurance data shows that floods, fires, hailstorms, and windstorms have inflicted the highest financial tolls on businesses, households, and financial institutions in recent years. These losses have also increased in magnitude over the last decade. From 1983 to 2008, the insurance industry paid out CAD$250-450 million each year on average for natural catastrophes. Since 2009, payouts have averaged CAD$1.8 billion, many of which relate to flooding. Residential basement flooding has cost insurers the most in Canada in recent years.

How should businesses respond to these physical risks? First, they need to throw out what they think they know about extreme weather events. Anthropogenic warming has, and will continue to, alter the climate system in ways that will have unprecedented consequences. This means the past will be no guide to the future.

Second, they need to invest in adaptation — those activities that could protect them from the physical risks to come. A mistake that some businesses are making today is assuming that such investments are expensive and unnecessary. The truth is that the cost to build climate resilience today is less than the cost of the financial losses that could be inflicted tomorrow.

Third, they need to be active, not passive, in fighting the causes of climate change. This means working to mitigate the effects of climate change, for example by reducing GHG emissions, improving energy efficiency, and engaging with other companies to bring down their entire industry’s carbon footprint. This ‘precautionary approach’ could head off worse physical risks in the years to come.

Some businesses today may think they are immune to physical risks because they have yet to be hit by an extreme weather event. This may prove to be a very expensive illusion. Climate change will fundamentally transform the distribution, intensity, and frequency of acute and chronic risks. No business can credibly claim to be ‘safe’ from these impacts going forwards. The safest strategy, then, is to be prepared.

If this blog has piqued your curiosity, visit our on-demand webinar page to see the discussion the blog was based on along with other webinars on a variety of climate-related topics.