New rules will force banks to publish stacks of climate data — but their usefulness may be limited

Risk disclosures are supposed to alert investors to looming threats lurking on bank balance sheets and give them the information needed to make smart trading decisions. Post-financial crisis, the publication of such disclosures was enshrined under ‘Pillar 3’ of the bank regulatory framework put in place by the Basel Committee, a global standard-setter.

Pillar 3 reports are therefore the obvious place for financial regulators to make banks publicize their climate risks. Last month, the European Banking Authority (EBA) took this very step by publishing binding standards on the disclosure of ESG risks. These will bulk out European banks’ Pillar 3 reports with data on how climate change could roil their loan books, as well as information on their financing of ‘green’ activities, as defined using the European Union’s sustainable taxonomy.

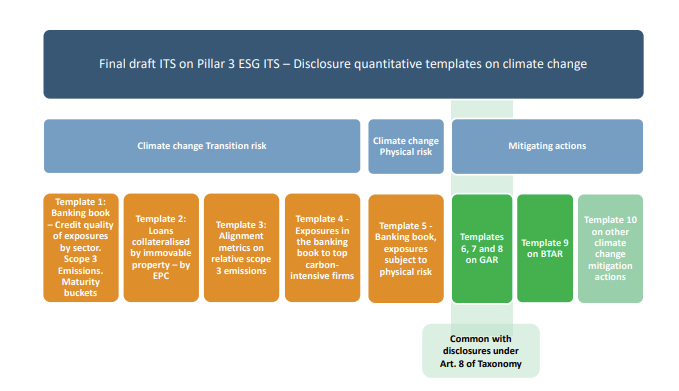

The standards include three standardized tables and ten standardized templates that banks will have to populate with their own data, starting from 2023. Each of the ten templates covers a distinct climate risk or mitigation metric. Together, they should shed new light on banks’ transition and physical risks, and the extent to which their activities support the EU’s own climate goals.

Source: EBA

Or will they? The usefulness of Pillar 3 disclosures for assessing traditional bank risks is questionable, to say the least. Take, for example, the multi-bank blowup triggered by the implosion of Archegos Capital Management, a New York-based family office run by hedge fund veteran Bill Hwang. The collapse of the firm inflicted over $10 billion of losses across a roster of banks. Credit Suisse alone took a $5.4 billion hit.

Did Pillar 3 disclosures provide a timely warning of the dangers posed by the banks’ exposure to Archegos? As ‘FinTwit’ (Financial Twitter) stalwart @JohannesBorgenpointed out, in Credit Suisse’s Pillar 3 report it was impossible to see the nominal exposure to Archegos, or any indication of the risk it posed.

One problem is how bank reporting rules ask firms to calculate their economic exposure to counterparties, after taking into account safeguards like posted collateral. Another is banks’ reliance on in-house methodologies to estimate their risks. Calibrated poorly, these can dramatically understate the actual threat posed by financial counterparties.

The same two problems may limit the usefulness of the EBA’s proposed disclosure standards.

First, the calculation problem. One issue is that a number of the climate metrics are tied to EU classifications of what is (and isn’t) ‘green’. The trouble is these classifications do not always align with what climate science considers to be climate friendly.

Earlier this month, the European Commission said natural gas and nuclear power plants would be considered eligible investments under the EU’s sustainable taxonomy, in defiance of the bloc’s pledge to be climate neutral by 2050 and against the wishes of climate-conscious investors, as well as many EU member states. Two of the EBA’s proposed climate metrics — the Green Asset Ratio (GAR) and Banking Book Taxonomy Alignment Ratio (BTAR) — ask banks to detail the amount of assets they have aligned to this taxonomy. Doing so using the Commission’s proposed version would have banks count climate-harming activities as ‘green’, distorting the true extent of their environmentally sustainable funding.

True, the GAR and BTAR are measures of a bank’s funding of climate mitigating actions, not a straight up measure of climate risk. The EBA’s climate change transition risk template takes a different approach. It tells banks to disclose their exposures to “sectors that highly contribute to climate change”, as specified in the EU’s Climate Benchmark Standards Regulation. It further asks them to single out the amount of exposures in each sector that are “towards companies excluded from EU Paris-aligned Benchmarks” — meaning those particularly harmful to the climate. These cover:

- Companies that derive 1% or more of their revenues from exploration, mining, extraction, distribution or refining of hard coal and lignite;

- Companies that derive 10% or more of their revenues from the exploration, extraction, distribution or refining of oil fuels;

- Companies that derive 50% or more of their revenues from the exploration, extraction, manufacturing or distribution of gaseous fuels;

- Companies that derive 50% or more of their revenues from electricity generation with a GHG intensity of more than 100g CO2e/kWh.

When it comes to the first two categories, climate activists should have little cause for complaint. The Global Coal Exist list — an NGO-compiled roster of companies that “play a significant role in the thermal coal value chain” — covers firms that make 20% or more of their revenue from the black rock. Exposures to all these, then, should be captured by the transition risk template.

The latter two categories, though, mean that banks need not flag exposures to companies that make a hefty chunk of their cash through natural gas or carbon-intensive energy production as transition risks. This seems odd. After all, a bank may lend to a power company that makes 49% of its revenues from electricity generated at, say, 300g CO2e/kWh and the rest from electricity generated at 100g CO2e/KWh and have that not reported as a particularly concentrated transition risk.

Remedying this, however, is an accompanying template that asks banks to disclose their exposures to the top 20 most carbon-intensive companies in the world, as determined using publicly available data. This should offer a clear and comparable view of the very dirtiest segments of banks’ portfolios, and thus how damaged they would be if these ‘carbon hogs’ were to implode.

Second, the methodologies problem. In its standards, the EBA does not prescribe what approaches banks should take to fill in certain templates — opening up the possibility that they will use different methodologies that are not strictly comparable.

For example, the climate transition risk template — as well as asking banks to disclose their exposures to companies excluded from EU Paris-aligned Benchmarks —also tells them to report their financed emissions: the GHG attributable to their lending and investing activities.

Yes, this is an important and valuable disclosure that climate activists have long been clamoring for. After all, having banks detail the carbon footprint of their loan books will allow stakeholders to see just how much each contributes to global warming, and identify those exposures most vulnerable to transition risk.

However, the EBA does not tell banks how to calculate and/or estimate these financed emissions. This could lead to a situation whereby two banks with the same loan portfolios publish wildly different financed emissions amounts because they rely on different emissions databases and methodologies. How, then, to reconcile them? True, the EBA does ask banks to provide narrative information alongside the reporting template on the methodology and sources they use. But this only helps explain the basis for differences in reporting, it cannot make them comparable.

Perhaps prescribing a single methodology would have been too controversial given that emissions data is an evolving field. Here’s what Pilar Gutierrez, senior policy expert at the EBA, told Climate Risk Review:

“In terms of GHG emissions, we acknowledge there are challenges getting the data for banks. That’s why we are not prescriptive on methodologies, but we are telling banks to explain the methodologies they are using so we get a good understanding of the sources of information and the differences between banks. We hope the combination of quantitative information and explanations will help users to understand what banks are disclosing”

Still, the EBA did have other options. It could have, for instance, told banks to use the industry-led Partnership for Carbon Accounting Financials (PCAF) methodology on a ‘comply-or-explain’ basis. As it stands, there’s nothing to stop a bank cooking up its own in-house financed emissions methodology, which may understate the carbon in its portfolio, much like how an internal credit ratings models may lowball its default risk.

Besides these shortcomings, there are some omissions from the disclosure standards that rob stakeholders of an all-round view of banks’ climate risks. Most notably, they do not include a reporting template for banks’ trading book assets, which the EBA said made up 15.5% of their total portfolios on average in Q3 2020.

True, trading book exposures are often short term. Banks buy and sell bonds, equities, and derivatives to make a quick buck or to facilitate client demand. Climate risks, on the other hand, are expected to materialize over the medium to long term. The EBA said this mismatch justified a different approach to reporting. Said Gutierrez:

“We received feedback that the template was not very meaningful for the trading book and that we need to look at other ways to get relevant information. So we decided to drop it for the moment. [We are thinking about] what is the best way to reflect how the trading book may be impacted by transition risk, by physical risks, and we have to think not just point-in-time information but also the evolution of the trading book across the year”

However, it’s also true that trading book risks can blow up just as spectacularly as those housed in the banking book. The ‘London Whale’ trading loss suffered by JP Morgan in 2012, for example, ended up costing the bank a cool $6 billion, plus $920 million in regulatory fines. Furthermore, there’s no guarantee that certain climate risks won’t strike in the short term. Think about a sudden, sharp upwards spike in the price of carbon in the EU, or a cascade of energy company bankruptcies.

Neither risk is implausible. Indeed, the latter manifested in the UK last year — but because of high gas prices rather than climate risk. These kinds of threats could slash the value of certain trading book assets, which could in turn lead banks to offload them at fire-sale prices, further roiling financial markets. This being the case, it’s odd that the EBA should defer disclosure of these risks to a future date.

Another omission is sovereign risk. The EBA’s templates exclude banks’ loans to, and bond holdings in, national governments on the grounds that there is no way to map governments’ activities to the sector classification used for private industries. However, if ‘sovereign risk’ is understood as ‘country risk’, then this is no excuse. After all, a government’s ability to repay its lenders depends on its tax base, which in turn reflects the goods and services produced within its territorial bounds.

The Bank of England estimated its own exposure to UK sovereign transition risk using the proportion of UK GDP attributable to “the extraction and production of natural resources” — namely, fossil fuels. Another way to proxy this would be to assess how aligned a country’s climate policies are with the emissions pathway required to achieve the Paris Agreement’s temperature goal.

When it comes to sovereign physical risk, there are third-party data providers that ‘score’ countries’ current and expected future exposures to chronic and acute climate threats. The EBA could have told banks to use this data to populate the relevant disclosure templates. Instead, as it stands stakeholders will get no insight on these risks at all. Banks’ sovereign exposures aren’t small, either. The EBA itself said these made up 12.2% of banks’ total assets in Q3 2020.

Excluding trading and sovereign exposures from the templates prevents stakeholders from seeing the full range of banks’ climate risks. The lack of prescriptiveness on climate risk calculation methodologies, meanwhile, undermines the EBA’s goal of extracting consistent and comparable information from banks. These two shortcomings mean the clamor from climate activists for meaningful climate risk disclosures is unlikely to die down anytime soon.

Yes, there’s plenty the disclosure standards get right, and there’s no doubt they will unleash a flood of climate risk data that banks may not otherwise have produced, let alone publicized. However, the omissions and compromises riddled throughout means that they should be considered a good first step by the EBA — not ‘job done’.