The top five climate risk stories this week

1) DWS Group chief resigns after greenwashing raid

The head of global asset manager DWS Group said on Wednesday he would resignfollowing a raid on the company’s Frankfurt offices by German authorities investigating greenwashing claims.

Asoka Woerhmann, who has captained the near $1 trillion asset manager since 2018, will step down after the firm’s annual general meeting on June 9. He will be succeeded by Stefan Hoops, the Head of the Corporate Bank at Deutsche Bank, which is the majority owner of DWS.

On Tuesday, around 50 agents from the Frankfurt public prosecutor’s office, together with officials from Germany’s financial regulator BaFin and the federal criminal police office, entered DWS and Deutsche Bank property to investigate suspected investment fraud. In a statement, Deutsche Bank confirmed that the agents’ presence was related to “unknown people in connection with greenwashing allegations against DWS.”

The Wall Street Journal reported last year that DWS was being probed by BaFin and the US Securities and Exchange Commission in the wake of allegations by the firm’s former sustainability chief, Desiree Fixler, who claimed the firm overstated the amount of assets invested using its ESG screening process.

DWS said in its 2020 annual report that over half of its $900 billion assets at the time were subject to ‘ESG integration.’ Fixler said that in reality only a fraction of assets went through this process. She also alleged that the ESG integration process did not screen out companies involved in climate-harming activities like coal and fracking. Fixler was fired by DWS last March before the annual report’s release.

2) GFANZ to debut climate transition framework

The world’s largest climate finance alliance will publish a global framework for financial institutions’ transition plans to help transform their net-zero pledges into meaningful action.

The Glasgow Financial Alliance for Net Zero (GFANZ), a coalition of new and existing climate finance initiatives covering banks, insurers, asset managers, asset owners and more, plans to release the framework for consultation on June 15.

Alice Carr, Executive Director for Public Policy at GFANZ, described the framework on a virtual panel at the Green Swan Conference hosted by the Bank for International Settlements (BIS) on Wednesday.

“We’ve convened the private sector, [and] we’re also drawing on technical experts and civil society, to set out what we think a good transition plan for a financial institution should have and … what they now need to start using in order to turn their commitments into tangible action,” said Carr.

The GFANZ framework says financial institution transition plans should have five main elements, Carr explained. First, they should clearly set out what goals they are trying to achieve and by when. Second, they should describe business line by business line how they intend to deliver on these goals. Third, they should engage with households, businesses, and governments to bring about conditions that support a transition in the real economy. Fourth, they should set out metrics and targets so that external stakeholders can track their progress. Fifth and finally, they should have good governance, from the board of directors down.

Carr added that other tools and guidance would be issued by GFANZ to assist with transition planning, including pointers on how firms should use sectoral decarbonization pathways.

GFANZ was launched in April 2021 by the UN Special Envoy for Climate Action and Finance Mark Carney. Today, it includes over 450 member firms representing more than $130 trillion in assets under management and advice, including global banks JP Morgan, Citi, Barclays, and BNP Paribas.

3) Greenwashing a threat to the financial system — BoE’s Breeden

Greenwashing could undermine trust in the financial system and increase the risk of a disorderly climate transition, a senior official at the Bank of England (BoE) warned.

Sarah Breeden, the BoE’s leader on climate change, outlined a number of major risks to the financial system’s efforts to power a low-carbon transition at a virtual conference on Wednesday. One risk was attaching ‘green’ labels to activities that do not support the shift to a net-zero emissions economy.

“That matters because we risk losing trust in the role of the financial system in supporting the transition. But it also matters because of the substantive consequence that if we think we’ve been investing in the ‘green’ and we’ve not, we’ve not been making the progress that we need. That then leads to the risk of a disorderly transition,” said Breeden.

She added that a disorderly transition is likely to bring greater risks to businesses and households than an orderly shift to net zero, as the results of the recently completed BoE climate stress test imply.

Breeden’s concerns on greenwashing echoed those made by the European Central Bank in its recent Financial Stability Review. This warned that greenwashing could threaten financial stability by making market participants underestimate their climate transition risks.

Another big risk Breeden cited was “paper decarbonization,” where financial institutions spend big on activities and products that are considered ‘green’ in the here and now instead of investing in the future economy, which will drive the bulk of decarbonization. This risk has been fueled by the absence of data and lack of certainty over the world’s future climate pathway, she explained.

Breeden said that “a swift response from financial regulators and international disclosure standards” may help ameliorate these risks, but that there is much more work still to be done.

Breeden was speaking at the virtual Green Swan Conference hosted by BIS. The event brought together central bankers, executives from private financial institutions, and experts to discuss monetary policy setting against the backdrop of climate change and the role of finance in the climate transition.

4) CFTC to investigate climate risks to derivatives

A top US financial watchdog wants to know how climate risks could impact derivatives markets and the entities that trade them.

On Thursday, the Commodity Futures Trading Commission (CFTC) — which oversees markets in futures, swaps and options — announced a Request for Information (RFI)to solicit public feedback on climate-related market risk. In particular, the agency is seeking responses on questions related to climate data, scenario analysis and stress testing, risk management, product innovation, and voluntary carbon markets, among others.

CFTC Chair Rostin Behnam said the Commission may use the public feedback to take action to address climate risks, for example by issuing new regulations, guidance, or policy statements. “My intention is to focus on ensuring that America’s farmers, ranchers, manufacturers, commercial end-users, and investors are equipped to manage their risks from increasingly severe and frequent weather events as well as the transition to a net-zero, low-carbon economy,” Behnam added.

Though all five CFTC Commissioners voted for the RFI, the two Republican officials said that some of the questions touch on matters beyond the agency’s statutory authority. “We are not … a prudential banking regulator like the Fed, OCC, or FDIC, nor are we a primarily disclosures-based market regulator like the SEC. Keeping our focus on our markets, products, and purpose — keeping our eyes on the ball — will help us avoid the risk of diluting our limited resources and potentially straying from our core expertise and responsibilities into areas already tasked to others,” said Commissioner Caroline Pham, one of the two Republican Commissioners.

The RFI was announced at the CFTC’s first-ever meeting to discuss the trading of carbon offsets and carbon derivatives.

5) Net Zero asset managers unveil decarbonization targets

Almost one-third of firms that are part of the Net Zero Asset Managers Initiative (NZAMI) have set targets for aligning their clients’ assets with net zero by 2050 pathways, a new report shows.

Published Tuesday, the report shows that to date 83 NZAMI members out of 273 total have set initial targets, covering some $16 trillion of assets under management (AUM). That represents 39% of the 83 companies’ total AUM, an increase of four percentage points on November 2021.

Twenty-four members have aligned 100% of their AUM to net zero, including the UK’s Cardano, the US’s Generation Investment Management, Norway’s Storebrand Asset Management and Finland’s Handelsbanken Fonder. On the flipside, some of the initiative’s largest members have set low initial targets. For example, Vanguard, which has $7.2 trillion in AUM, has set an initial target covering just 4% of its portfolio. State Street Global Investors, with $4 trillion in AUM, has a target for just 14% of assets.

Three asset managers’ targets were rejected by the initiative as they did not meet the NZAMI’s minimum requirements.

Signatories to the NZAMI commit to managing assets in line with net zero by 2050 and setting interim targets for 2030 that align with a 50% global reduction of greenhouse gas emissions. Within a year of joining the initiative, asset managers have to disclose the initial percentage of their portfolios that will be aligned with net zero, their interim targets, and the target setting methodology used.

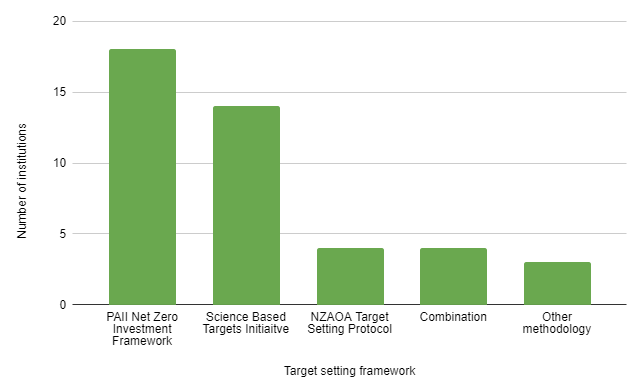

Target setting frameworks in use by Net Zero Asset Managers Initiative members

Asset managers can use the most appropriate target methodology for their business, though three have been endorsed by the NZAMI’s network partners — the Paris Aligned Investment Initiative’s (PAII) Net Zero Investment Framework, the Science Based Targets Initiative framework for financial institutions, and the Net Zero Asset Owner Alliance Target Setting Protocol. The most popular methodology in use by NZAMI members to date is the PAII Net Zero Investment Framework.