The European Central Bank’s review of climate risk management practices shows plenty of firms aren’t even bothering to assess how painful future climate threats could be

Climate risk pundits have plenty to chew over in the European Central Bank’s (ECB) latest report on the state of climate and environmental (C&E) risk management in the banking sector.

The headline findings depict European Union banks as eager, if slow, to tackle their climate risks. No lender is close to meeting all 13 of the climate-related supervisory expectations the ECB laid down a year ago, but almost all have made implementation plans to get up to speed. These plans, though, vary in quality and content. Around two-thirds of banks “have failed to tailor their plans sufficiently to their specific situation”, the ECB says, while many “lack operational details on how the deliverables will actually be produced, do not contain interim milestones, and/or focus on either transition risk or physical risks”. In other words, many plans aren’t worth the paper they’re printed on.

Banks face plenty of challenges getting their C&E risk management practices up to scratch. Indeed, many may be incapable of operationalizing some of ECB’s expectations at this point in time. The central bank itself admits that “data and methodological gaps may make it difficult to fully implement the supervisory expectations in some cases”. In its own quiet way this is a remarkable statement — a supervisor admitting that demands made of its own supervisees may be beyond their capabilities, not because of their own shortcomings, but because of the state of the climate risk space itself.

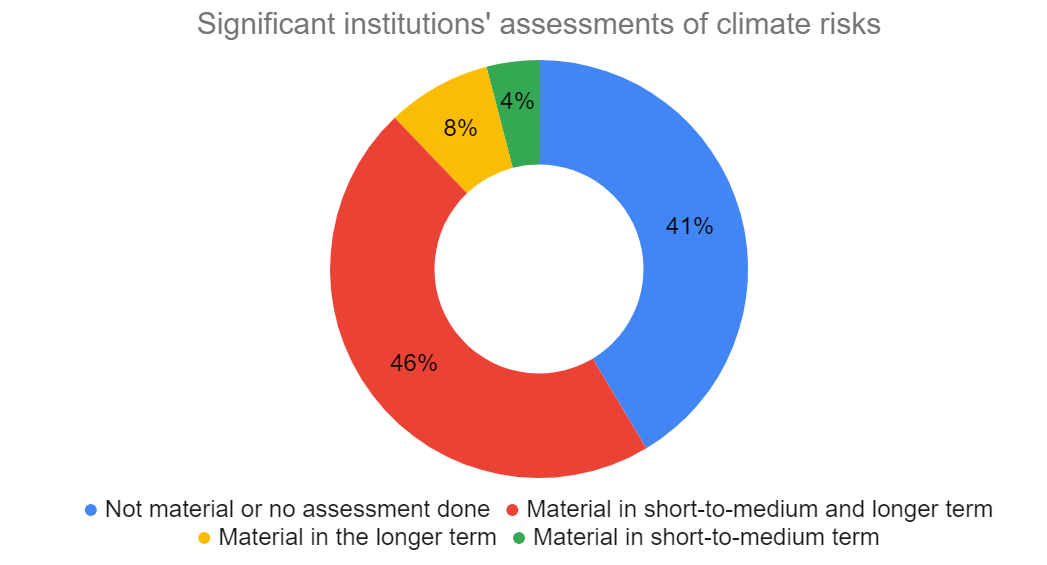

One issue in particular that EU banks are clearly struggling with today is defining the materiality of C&E risks. The report states that while almost all significant institutions with asset bases of over €500 billion (16 banks in total) say both physical risks and transition risk are material risk drivers, just half of the remaining 96 smaller banks in the sample say the same. Why? Because many have yet to conduct any climate risk materiality assessment. In fact, the ECB found roughly four in ten banks either do not run such assessments or performed assessments with significant shortcomings:

“For example, some institutions either made insufficient use of the available data to quantify the risks and did not develop (qualitative) proxies for risk drivers that are too difficult to quantify. Other institutions did not assess the risks in a sufficiently comprehensive manner and failed to include both transition and physical risk drivers or to cover all conventional risk types”

Many banks also don’t seem to think explaining their approach to materiality assessments is an important part of their climate risk management processes. The ECB’s expectations tell banks “to specify in their disclosure policies key considerations that inform their assessment of the materiality of climate-related and environmental risks, as well as the frequency and means of disclosures”. But in the report, the central bank explains that “few [implementation] plans indicate whether disclosure policies include the key considerations that underpin the materiality assessment of C&E risks”.

Climate risk materiality assessments should be table stakes for banks. It’s not as if the ECB laid out a peculiarly awkward process for firms to follow, either. In its supervisory expectations, the central bank said materiality should be considered through the lens of already existing bank rules and standards. Still, the report found that in some cases banks do not plan to finalize a materiality assessment of C&E risk drivers before the end of 2023 — three years after the publication of the ECB’s expectations.

How come so many institutions appear stuck on materiality assessments? And why could it take so long for the laggards to get a move on?

For many banks, practical hurdles stand in the way. Materiality assessments depend on data, but as has been stated again and again, right now there are large gaps in the data on how climate-related risks could impact individual banks and the financial system as a whole.

Costs, too, could be a factor for smaller firms. Europe’s megabanks have extensive internal resources, including sophisticated modelling capabilities, data gathering and management processes, and — of course — big teams of risk experts, some of whom even specialize in climate change. Minor lenders have far fewer existing resources to draw upon. This means implementing and scaling up climate risk management programs — including materiality assessments — will require fresh investment on their parts.

Many banks may simply be unable to, or perceive themselves as unable to, front the money for this kind of project. As the ECB’s latest Financial Stability Review showed, EU bank profitability is lower than in other jurisdictions thanks to “low cost-efficiency, limited revenue diversification, overcapacity and compressed margins in a low interest rate environment”. With these structural factors weighing on them, it’s no surprise that many firms may want to defer potentially costly internal programs for another day.

The accessibility and affordability of third-party climate solutions, which can help with materiality assessments, may also play a role. Despite rapid advances in recent years, the market for climate data, scenario analysis, and risk management is still young. Many potential vendors to EU banks are in the startup phase still, and are yet to scale. The few established players, meanwhile, are likely focusing their attention on those clients with the fattest wallets and most complex climate risk profiles.

Then there are behavioral factors to consider. The significant institutions covered by the report are all directly supervised by the ECB and subject to the same supervisory expectations, regardless of asset size. However, it may be that right now only the very largest face sustained pressure from their regulators, investors, and activists to get their climate risk practices in order. Having yet to encounter the scrutiny their larger peers are subject to, smaller firms may be less incentivized to put effective materiality assessment practices in place.

It’s possible too that many banks don’t know how to integrate climate risks into their existing materiality assessments out of a lack of understanding of how these risks intersect with credit, market, liquidity, and operational factors. This may be linked to the abovementioned costs and resources limitations, but could also be due to institutional inertia. Banks that have used the same materiality assessment processes for years may simply not know where to start when it comes to integrating climate.

The absence of clear penalties for failing to follow the ECB’s expectations also cannot be discounted. Yes, the central bank has sent “individual feedback letters” to significant institutions following its review. And yes, in the future those banks that don’t conduct robust climate risk materiality assessment could receive a black mark through the ECB’s annual Supervisory Review and Evaluation Process (SREP). But, as the ECB itself explains, climate risk will only “gradually” be integrated into the SREP, and will only “eventually” influence the Pillar 2 capital requirements determined through this process. Plenty of banks may believe that in the absence of any proximate regulatory costs, there’s no need to rush when it comes to implementing materiality assessments.

Identifying the technical and behavioral obstacles holding back banks is the first step towards overcoming them. But though this is an important exercise, it somewhat obfuscates what should be a straightforward calculus. Climate change has, and will continue to, transform the planet, and every human system along with it. Therefore it is a material risk to every bank and should be considered as such.

Yes, the severity and proximity of this risk may vary from firm to firm. For some, it may not crest within the current capital planning cycle, even. But that does not mean it should not be considered material now. A hiker stuck on a railway track knows a train will hit them if they don’t act. Is the risk of death only material once the train is in sight and bearing down on them? No. It’s a clear and present danger for as long as they are stuck. Recognizing the threat and acting at the last minute would be ridiculous. Similarly, it makes no sense for a bank to neglect a materiality assessment and conclude that climate change is not a material risk in the here and now.